Contents

From stocks and options to even crypto, forex, and futures, there are many different platforms that you can invest and trade with in Canada. This page will compare the 15 best trading platforms in Canada for stock trading, day trading, options, CFDs, crypto, and forex. Usually you can choose from different trading accounts or service levels with one and the same Canadian forex broker, with which the minimum deposit is graded. With a higher initial deposit, traders gain additional services such as expert analyzes, personalized training courses, or access to information from providers such as Trading Central.

Options come with a commission of just $1.25 per contract. Assignment and automatic exercise of options come with a flat commission of $28.95. For those looking to short stocks or to trade on margin, Qtrade’s margin rate is Prime + 1.55% for CAD and Prime + 1.25% for USD. Negative balances for cash and registered accounts come with heavy interest penalties.

Using the above example, if the USD/CAD exchange rate is 1.2, it will cost C$1.20 to buy US$1.00. If the USD/CAD exchange rate rises to 1.3 it means that the base currency has risen in value compared to the quote currency . If you bought it at 1.2 and sold it at 1.3 you will have made a profit, and that is how forex trading works. MetaTrader 5 platform fully corresponds with the latest international practices of online trading via the NDD technology.

Withdrawals can be made back to the same credit card or debit card, or as a wire transfer to your bank account. If you’re a student 25 years of age or older, you can get discounted stock and ETF trades of $5.95, all with no annual fees and no minimum balance requirement. CIBC charges an annual account fee of $100 if your account balance is $10,000 or less. For certain registered accounts , the annual account fee of $100 is charged if your account balance is $25,000 or less.

Greater Boston Area Business ConnectionsGreater Boston Area Business Connections

It does not matter if the broker offers all the best trading tools in the world. It also does not matter if the trading platform looks attractive. None of these things are as important as top-quality customer service. Our team is dedicated to connecting Canadians with the best forex brokers in Canada, including accounts, trading apps, and any tax considerations. FX traders can feel safe and confident choosing from our recommended list of Canadian brokers for beginners.

Because Forex is a leveraged financial instrument it can be risky. Always practice healthy risk management when trading leveraged products, including calculating and adhering to your risk/reward ratio, strategy and investment goals. From the very beginning we have strived to offer our clients the most innovative products, tools and services.

When you open this type of account, an experienced trader or a group of traders will trade your money along with the money of other investors. Online Brokers offer different types of trading accounts for traders to choose. The first distinction of account types is between the live accounts, demo accounts, and Swap-free accounts. National Bank is the only major bank to offer completely commission-free stock and ETF trades through their online stock brokerage. National Bank Direct Brokerage lets you trade Canadian and U.S. stocks and ETFs with no commission.

Ava Trade – Best Forex Broker in Nigeria

If the execution speed is slow on that broker, then you should using avoid such a broker. If you are a scalper, for example, you need a broker that provides fast execution. With such a broker, there is an assurance that you will get the best price possible on each trade. Execution speed is very important during high volatility periods in the forex market. Stock trades cost $0.01 per share, with a minimum commission of $8.

This website is provided for informational purposes only and is not a source of official OSC policy or a substitute for legal or financial advice. We recommend that you consult with a qualified professional advisor before acting on any information appearing on this website. For details, please see our full Terms of Use and Privacy Policy.

We test the sign-up process over and over again to make sure everything goes smooth. Every broker that we recommend has a user-friendly platform. We urge BC residents to exercise caution when dealing with firms that are not registered to trade or advise in BC. British Columbia residents are able to open accounts through Sky Forex’s website.

The account fee for registered accounts is $100 per year if the account balance is less than $25,000. While commissions are higher than discount brokerages, you may be eligible for discounted commissions if you make 150 or more trades per quarter. RBC Direct Investing also offers free Level 2 quotes for stocks and ETFs listed on the TSX. If you’re an active trader, you may also be eligible to receive free Level 2 quotes for the Canadian Securities Exchange and NASDAQ stocks and ETFs. However, citizens of certain countries have to observe restrictions in their country. US traders can only make normal purchases and sales of crypto currencies with eToro without the leverage offered in other countries with CFDs.

- Just like the other banks, only Canadian and U.S. equities and options are offered.

- The higher the margin level you have, the more free money you have available to trade.

- No matter what happens during a trade you can rest assured that your account balance will never go below zero.

This is the rate that you pay to borrow money in order to buy stocks and other products using margin. Bank brokerages typically charge $9.95 per stock trade, but you can get discounted or even commission-free trades with some online brokerages. We recently became aware that Sky Forex Broker , purportedly based in Columbus, Ohio, offers high yield investment opportunities trading in forex. Since inception, FXCM has gained industry-wide recognition.

Such brokers are incredible and provide an excellent understanding of the market. If a trader is satisfied with the demo account, they can select the broker without any doubt. Forex trading has over the years become the go-to way for many people to make some extra money on the side. However, the large number of businesses offering trading accounts can be confusing.

Compare Forex Brokers

They transfer the fairness of the forex market to their clients worldwide wherever they might be and whatever their monetary goals are. Forex time is a credible forex investment company in Nigeria which you can give a trial if you are considering investing in the forex industry. https://forexbroker-listing.com/ Standard accounts can be opened with as little as $100 using credit cards or with $500 via wire transfer. They use several indicators such as moving averages, RSI, simple moving averages, technical overlays and more to determine the trends and movements of the market.

On the other hand, exchange rate companies in Canada do not enforce any restrictions on trading. Regulators make sure that brokers have a good trading environment and anti-money laundering processes, all the while operating strict auditing oversight and ensuring client fund protection. Brokers that are under regulation by one major regulator are more trustworthy. A micro lot is the same as 1,000 units of a base currency. One unique feature is that Oanda allows PayPal deposits via e-cheque. Other deposit methods include debit cards and bank wire transfer.

This is a difficult undertaking, especially for beginners. We have listed a good choice of forex official websites below to help you get started. With a 100-fold leverage on the liquid forex pair EURUSD, you can open a position over 3,000 dollars with a deposited capital of 100 dollars. Therefore, beginners should first get to understand the leverage effect in a demo account and begin carefully with small amounts. Mini account holders can place trades with a minimum of one mini lot size.

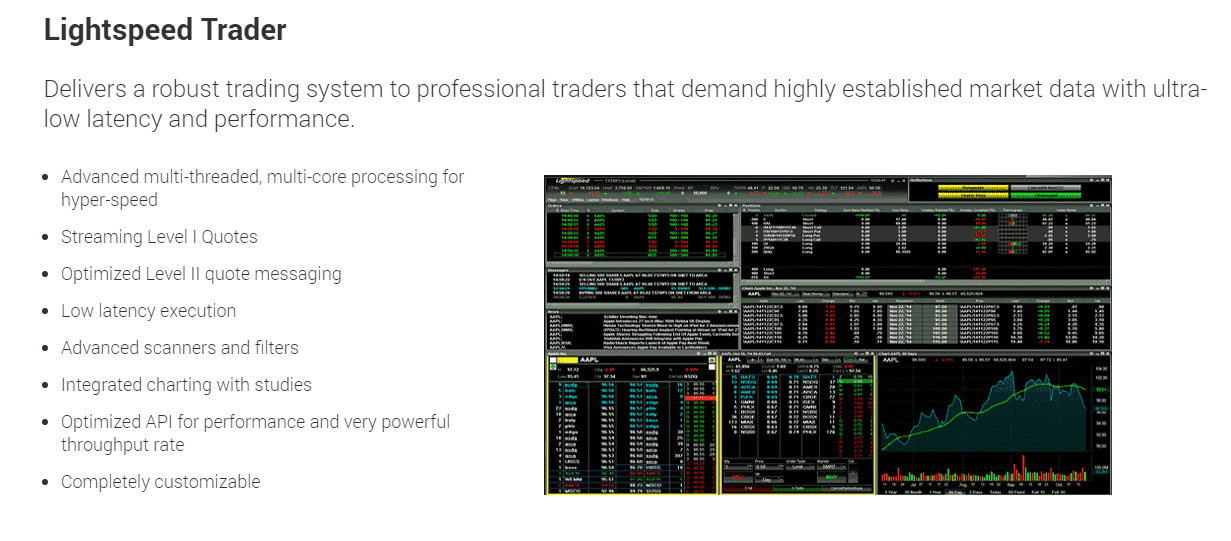

A proprietary trading platform is one that is specially developed by the broker for its clients. Bear in mind that trading conditions differ from one platform to another. For example, the spread on the proprietary trading platform can be lower than what you get on MT4 or MT5 for that particular broker.

Any profit made from a specific CFD trade with borrowed money will be significantly larger than profits made by simply investing owned capital. However, any losses will also be affected by the leverage, which means that losses can be larger than your initial deposit. Forex trading is legal in Canada and is controlled by both local regulators and the IIROC . When you are considering which forex broker in Canada is best for you, you want to confirm that they are registered with the IIROC by checking their broker licence. Before placing your first forex trade you want to consider developing a trading plan.

Metahero Price Prediction, Review, and Future Projection

While QTrade commissions are higher than Interactive Brokers and Questrade, they are discounted compared to the big banks. Stock trading commission is a flat $8.75, while options cost $8.75 plus $1.25 per contract. Wealthsimple Trade does not support margin trading or options trading. This forex broker listing means that you cannot short stocks with Wealthsimple Trade. However, you can open registered accounts such as TFSAs, RRSPs, LIRAs, and RESPs with Wealthsimple. Questrade is a popular Canadian discount brokerage that positions itself as an alternative to the major bank brokerages.

Cardano NFTs: Cardano NFTs Marketplaces

This reduces the cost of trading and currency conversion fees. If you’re between the ages of 18 and 24, and you have a CIBC Smart Account with CIBC Smart Start, you can get free stock and ETF trades, no annual fee, and no minimum balance requirement. Plus, the CIBC Smart Account is a bank account that offers free unlimited Interac e-Transfers and debit transactions, with free SPC+ membership.

Traders should read the documents regarding the right of a trader to recover any losses when opening an account at a high-leverage broker. The higher the margin level you have, the more free money you have available to trade. Conversely, the lower the margin level you have, the less money you have to trade.