Content

With this degree, graduates can interpret financial regulations, prepare financial reports, prepare tax returns, and audit a company’s financial records. The bachelor’s degree can also meet a major part of the criteria toward becoming a CPA or other certified accountant. As the name implies, tax accounting refers to accounting for the tax related matters.

- The primary function of financial accounting is to track, record, and recap all daily transactions into monthly, quarterly, and yearly financial statements.

- Due to the different requirements of each company, it’s imperative to have an idea of the different types of accounting services so you can help them to the full extent, and create more value for their growth.

- A staff accountant is a great option for anyone who has a bachelor’s degree in accounting and who wants a variety of work.

- The two types — or methods — of financial accounting are cash and accrual.

- The difference is that instead of tracking, analyzing and reporting financial information for a business or nonprofit organization, government accountants work for various public agencies.

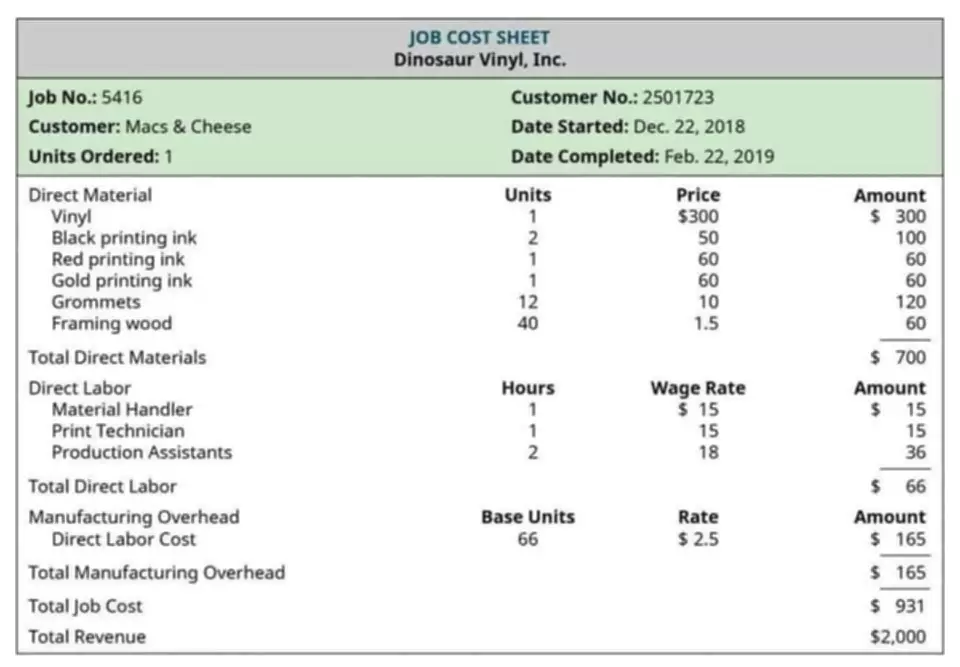

- A form of managerial accounting, cost accounting analyzes the company’s historical data on fixed and variable costs of making a product, plus the profit earned from sales.

Not simply tax-return preparers, accountants specialize in many different areas, including government, forensics, business finance, auditing, project management and investment strategy. Although tax preparation remains an important aspect of many accountants’ jobs, the accounting profession includes many diverse roles. Financial accounting involves the preparation of accurate financial statements. The focus of financial different types of accounting accounting is to measure the performance of a business as accurately as possible. While financial statements are for external use, they may also be for internal management use to help make decisions. Public accountants take care of the preparation, review, and audit of financial statements; tax work including income tax returns, estate, and tax planning; and do consulting activities for their clients.

What Effects Do Double-Entry Accounting Systems Have on Financial Statements?

For example, the GASB regulates government accounting processes, while the FASB sets the guidelines for GAAP. The Internal Revenue Code lays out the rules for individual and institutional taxpayers, and the American Institute of Certified Public Accountants establishes Generally Accepted Auditing Standards . These standards help ensure consistency and accuracy in financial reporting. Managerial accounting is the preparation and distribution of financial documents for internal stakeholders only. Managerial accounting is used primarily for budgeting, analysis and forecasting purposes, such as cost-volume-profit analysis and variance analysis.

How many fields of accounting are there?

There are twelve fields of accounting. These include managerial, financial, tax accounting, government accounting, non-profit accounting, auditing, forensic, political campaign, international, fiduciary, cost accounting, and accounting information systems.

Investopedia requires writers to use primary sources to support their work. These include white papers, government data, original reporting, and interviews with industry experts. We also reference original research from other reputable publishers where appropriate. You can learn more about the standards we follow in producing accurate, unbiased content in oureditorial policy.

The 8 Types of Accounting

This is a slight deviation from the financial accounting system used in the private sector. The need to have a separate accounting system for the public sector arises because of the different aims and objectives of the state owned and privately owned institutions. Governmental accounting ensures the financial position and performance of the public sector institutions are set in budgetary context since financial constraints are often a major concern of many governments. Separate rules are followed in many jurisdictions to account for the transactions and events of public entities. Tax accountants can work in a company or as an independent contractor, helping individuals prepare taxes and consider tax-related implications for financial decisions.

Also called financial accounting, this area of a company focuses on external companies that have expressed interest in the business. Employees create https://www.bookstime.com/ several financial statements to provide to investors. The most common ones include the balance sheet, income statement, and statement of cash flows.

Learn More at Ohio University

Social Accounting is still in the early stages of development and is considered to be a response to the growing environmental consciousness amongst the public at large. IFRS , are standards that are widely adopted in financial accounting. The accounting standards are important because they allow all stakeholders and shareholders to easily understand and interpret the reported financial statements from year to year. Internal auditing is the process of reviewing your financial and accounting practices, identifying mismanagements, exposing fraud in your processes, and testing your compliance with laws and industry regulations.